Newcomers to the field of investing in NFTs face inherent risks, as their lack of knowledge and data analysis skills may result in financial losses. However, a different outcome can be achieved by following experienced NFT experts who consistently generate significant profits. GoAlerts offers a copy trading-like experience in the NFT field, allowing users to track real-time information and seize opportunities before others.

According to NFTGo.io, within the NFT market, there are 288 whales who collectively hold NFTs valued at 686.33K ETH, accounting for 7.44% of the overall market cap of 9.22M ETH. These whales, with their significant holdings, often act as early movers and have the ability to influence market sentiment.

After reviewing these profitable whales, we conclude six strategies detailing how they make profit even in the bear market. These strategies include strategic batch and decline-rate buying, bottom-fishing for undervalued NFTs, strategic selection and diversification, exploring multiple platforms, bulk-minting, and prioritizing traits in projects. Therefore, we chose to analyze 19 different addresses in order to study trading behaviors that may be helpful to our users.

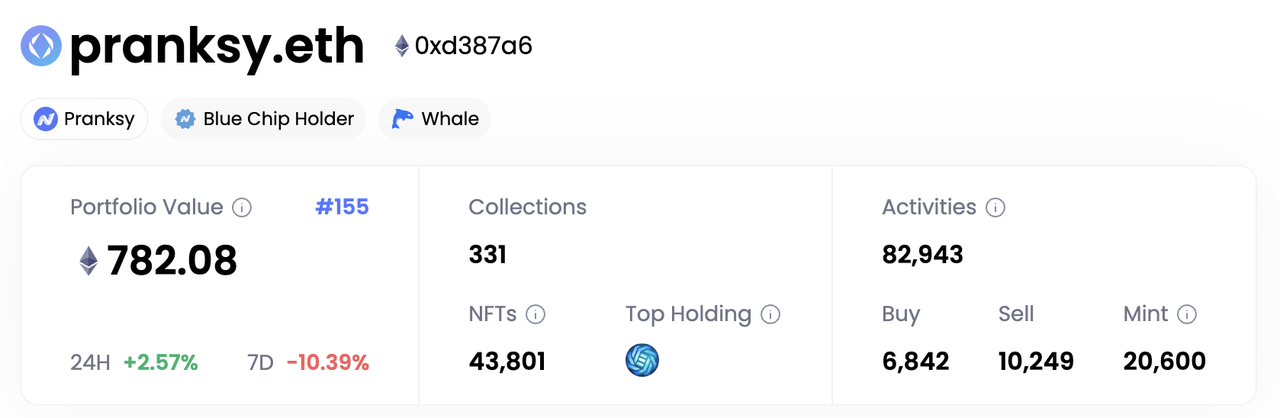

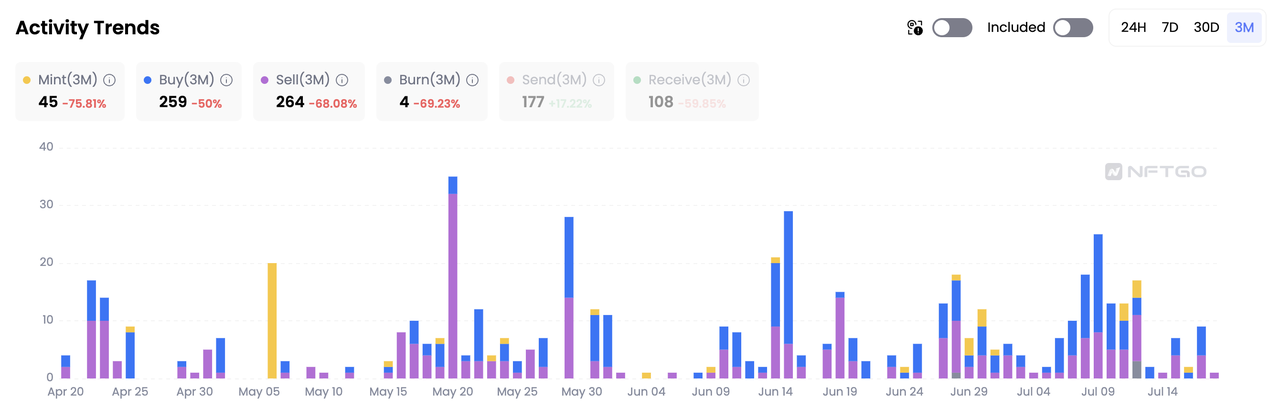

Pranksy.eth actively mints in batch and keeps his portfolio diversified.

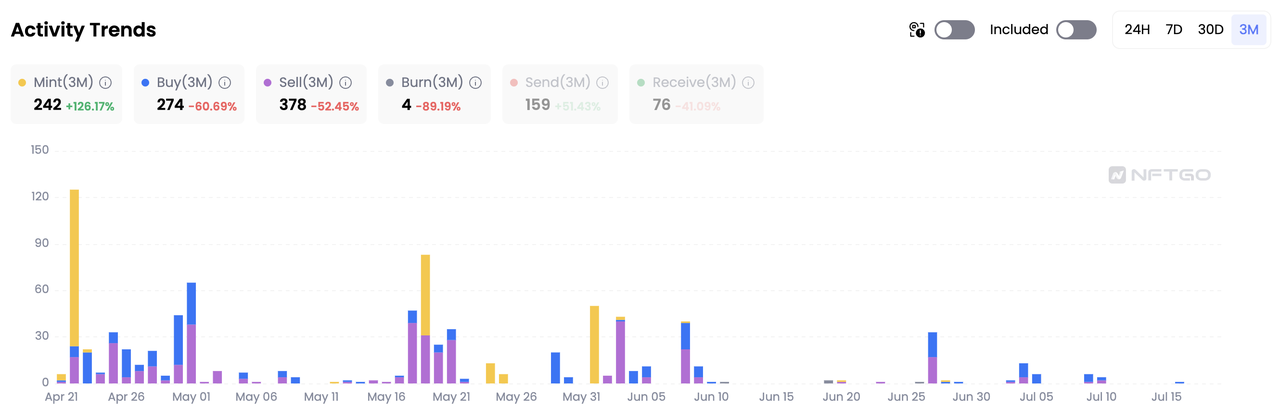

Over the past three months, pranksy.eth minted around 1.1K NFTs, including 121 from Ether Avatar and many from lesser-known projects. Furthermore, his portfolio is impressively diverse with 331 collections, 90% from micro-scale NFTs.

He's good at reducing exposure to single-project volatility and broadens the possibility of hitting high-value assets. Through these strategies, pranksy.eth creates 7.23K ETH profit in total while maintaining a balanced portfolio.

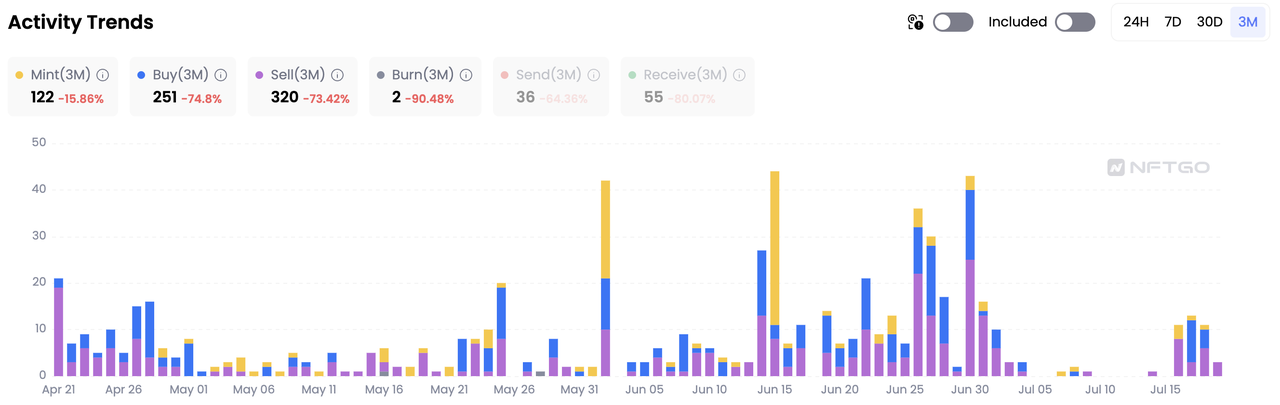

Chungster.eth possesses a remarkable ability to identify projects with promising potential, demonstrating a keen understanding of the NFT market pulse. With transactions resonating with trending themes like Opepen, Ether Avatar, and Azuki Elementals, Chungster.eth remains attuned to the evolving landscape of the NFT market.

Chungster.eth adapts to various platforms' preferences, with trading activities spread across Blur, OpenSea, and even more nuanced approaches like using OpenSea Pro via Blur or LooksRare Aggregator via OpenSea. This platform exploration amplifies opportunities, and broadens the scope of potential profitable trades.

Jklaub.eth implements a calculated risk-distribution strategy, trading and minting lesser-known NFT collections in bulk.

Balancing the equation between profits and losses, he strategically lets go of some assets below buying price, while awaiting returns on other items in the portfolio. For example, he bought 3 Wooonen on Jul 2nd at 0.0185 ETH for each, then he sold them out at 0.0155 ETH for two and 0.0222 ETH for one on Jul 3rd.

This approach, which showcases both diversification and astute market understanding, is designed to help him achieve 474.53 ETH overall profit in the ever-fluctuating NFT market.

Drewaustin.eth has realized 20x profits from many collections such as FLUF World.

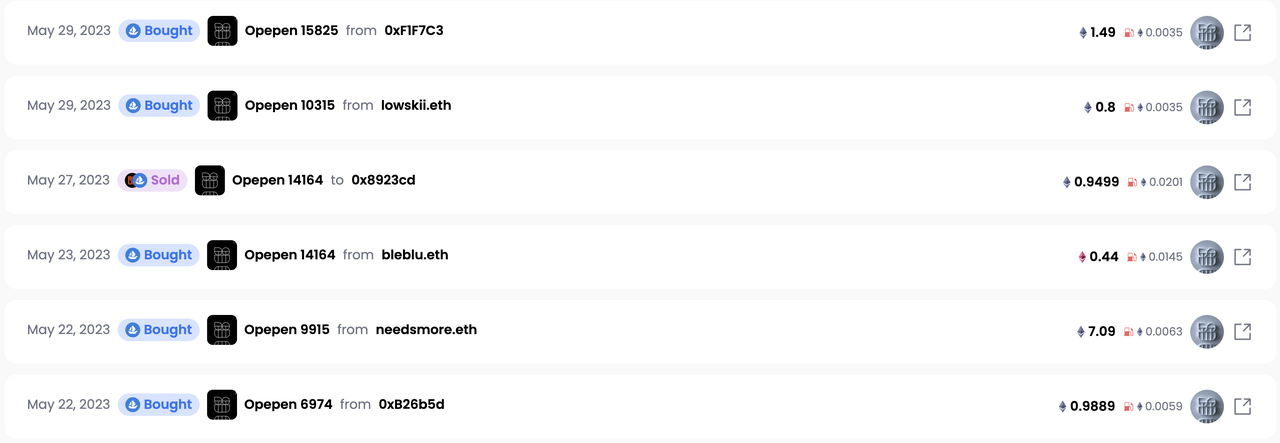

Notably, he showcases discerning judgment in both well-known and new collections, exemplified by his timely investment in the Opepen collection starting in May, a move that has consistently yielded profits.

Drewaustin.eth is a savvy investor who understands the benefits of platform diversity and the strategic selection of promising, under-the-radar projects.

Nyax.eth operates on a fast-paced, volume-driven trading strategy, pinpointing NFTs during price dips and swiftly turning them over for modest profits.

The individualized approach for some collections like OCB, Milady Maker, and Sproto Gremlin, suggests a deep familiarity with NFT characteristics and market values. However, for popular collections like BEANZ, the investor opts for batch buying, swiftly flipping these for quick turnover.

This strategy demonstrates adept market navigation and opportunistic profiteering.

Nakiri.eth utilizes a strategic trading approach, actively trading Otherdeed for Otherside and gaining 5x profit with only 6.9 ETH.

Nakiri.eth flipped Milady Maker with 3x profits, the average cost is 3.13 ETH while the average selling price is 3.53 ETH.

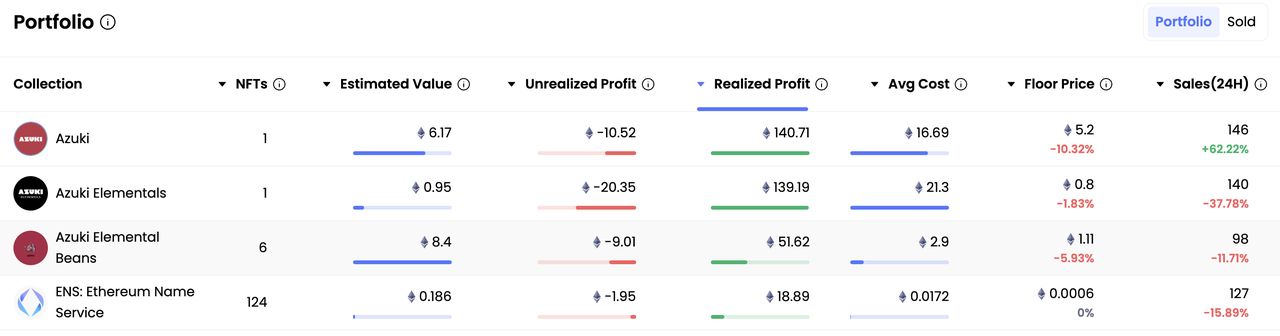

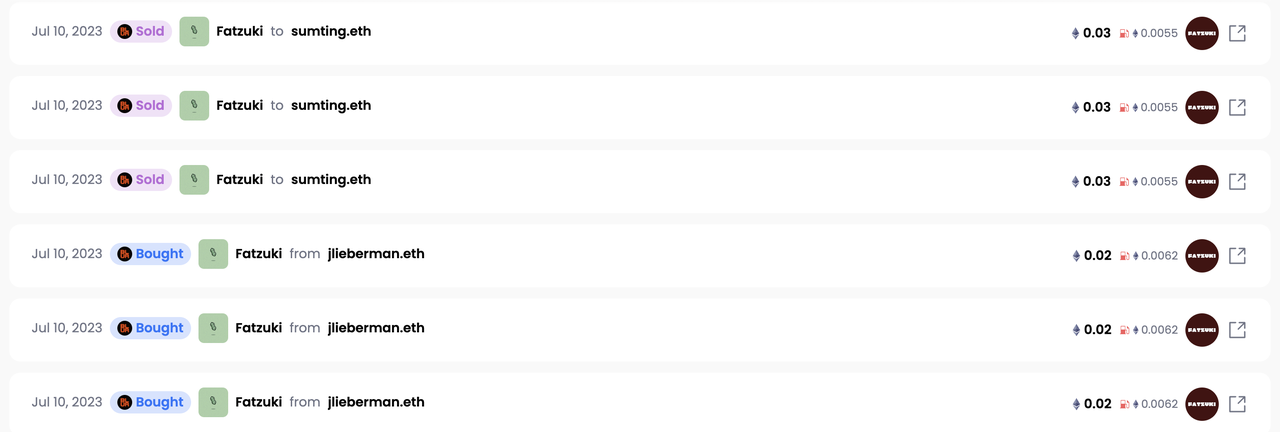

Not only does Nakiri.eth have holdings in renowned collections like Azuki, DeGod, and MAYC, but he can seize meme opportunities in short-term profit collections like Fatzuki by bulk trading.

Coodi.eth showcases a high-frequency trading strategy, concentrating on micro-scale collections and conducting transactions in bulk.

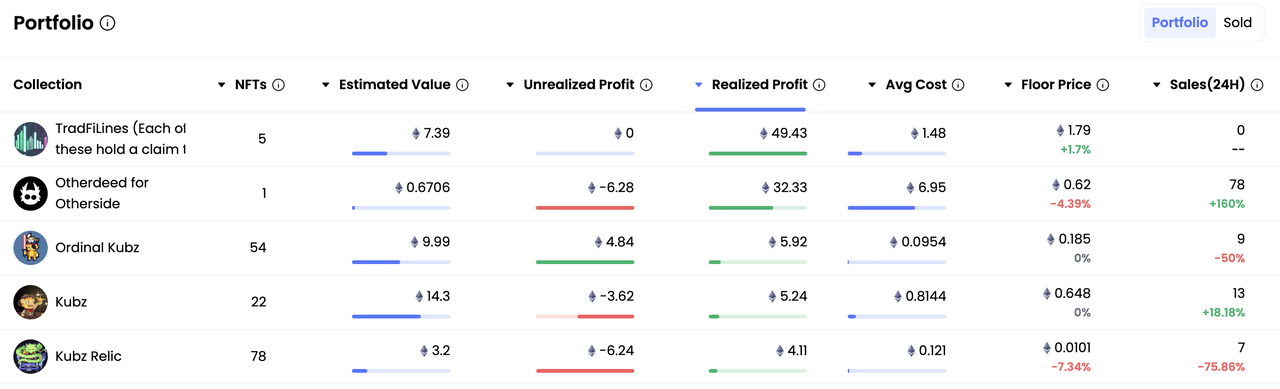

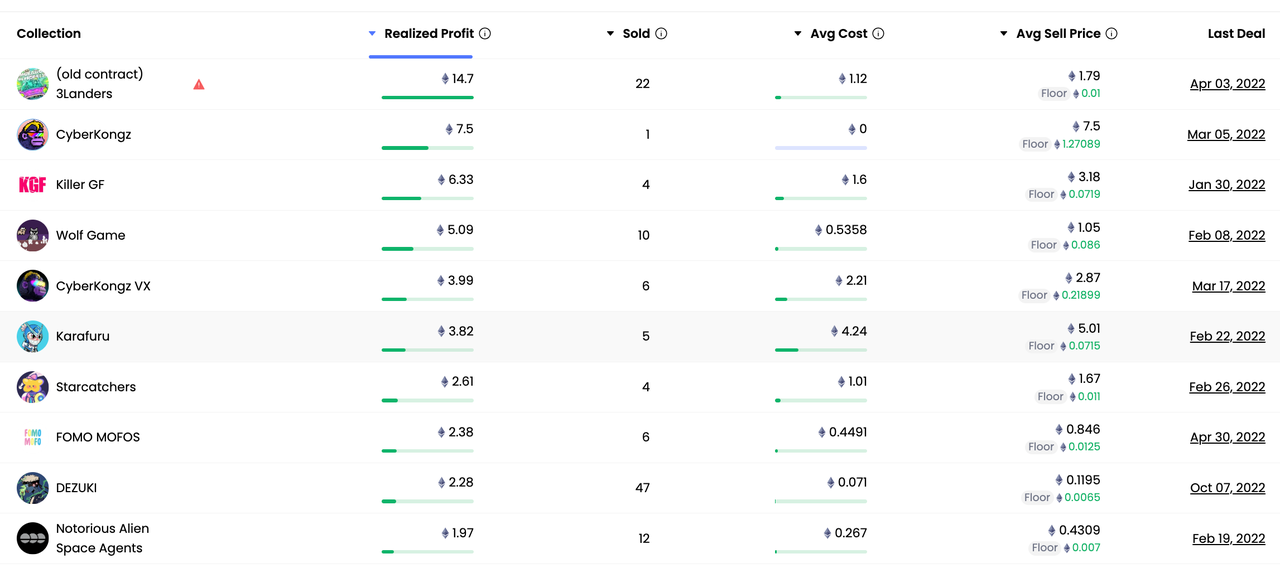

Normally, he chooses slim margins on each transaction but he also presents an intriguing selection of NFT collections. For example, flipped Killer GF, Wolf Game and Karafuru bring him with 15 ETH + profits in total.

Though Coodi.eth has 17.64 ETH profits in total, he can act as a rich resource for using a small budget to discover unique and less-publicized projects.

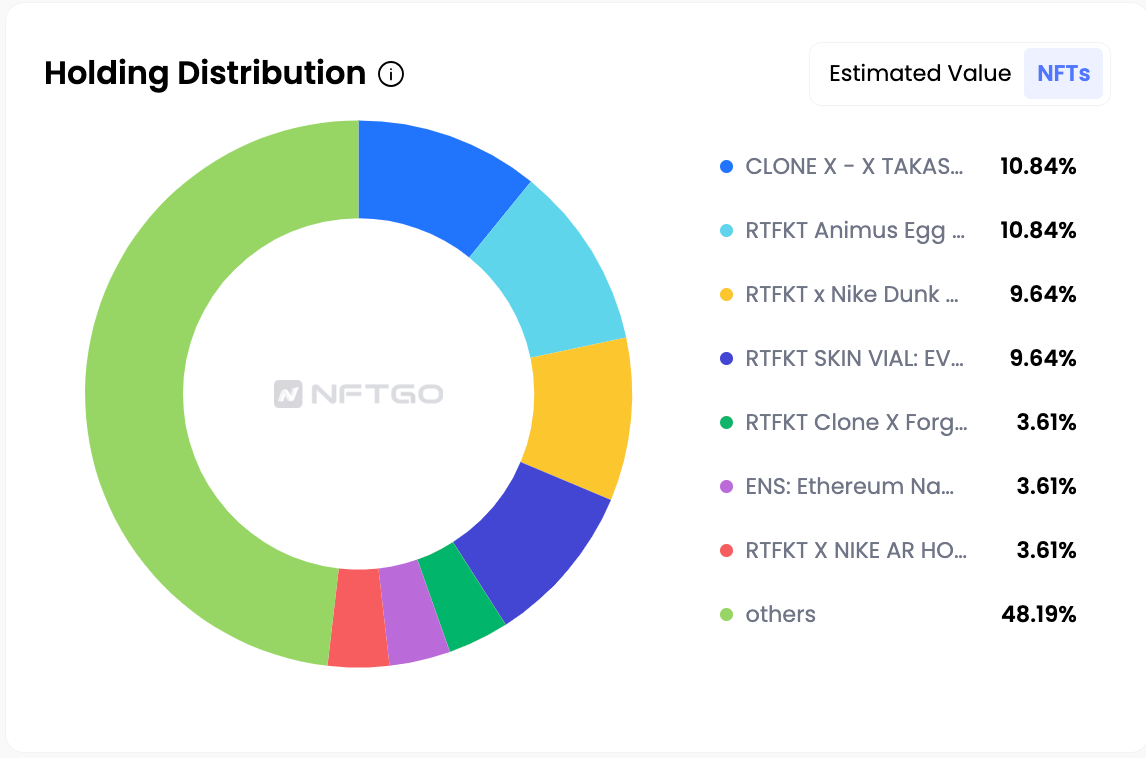

Samuelcardillo.eth is the CTO of RTFKT, and you can find him on Twitter at @CardilloSamuel.

Notably, a significant portion of samuelcardillo.eth's portfolio is allocated to RTFKT, occupying approximately half of his holdings. If you are an RTFKT series holder as well, tracking this address could provide valuable insights and opportunities to stay updated on RTFKT's latest progress and observe data movements.

Died.eth purchases well-known collections in bulk during price dips, holds them until the price recovers, and then sells them in bulk for profit.

For Azuki Elemental Beans, he successfully purchased in bulk at about 1.3 ETH per unit on Jul 2nd and sold at around 1.65 ETH on Jul 9th;

For Otherdeed for Otherside, he realized 295.51 ETH profit, with average cost at 35.4 ETH, and selling price at 50.95 ETH.

Besides, died.eth also took use of different trading platforms, like LooksRare, OpenSea, and Blur.

This address proficiently employs a mix of strategies such as batch buying, bottom-fishing, and diversification.

He bought similar NFTs in bulk, like 8 DeGods, 6 Azukis, and 8 MAYCs at the same time respectively.

In Bottom-Fishing, this trader showcases adroitness, purchasing Fatzuki NFTs at a low price of 0.2 ETH and swiftly selling them at 0.3 ETH.

This address's portfolio only contain 4 collections, but the trader's activity spans over 10 collections. Mostly focused on BAYC, MAYC, Azuki, and Azuki Elementals, but also incorporates mid-scaled collections, like Moonbirds, Milady, and Captainz.

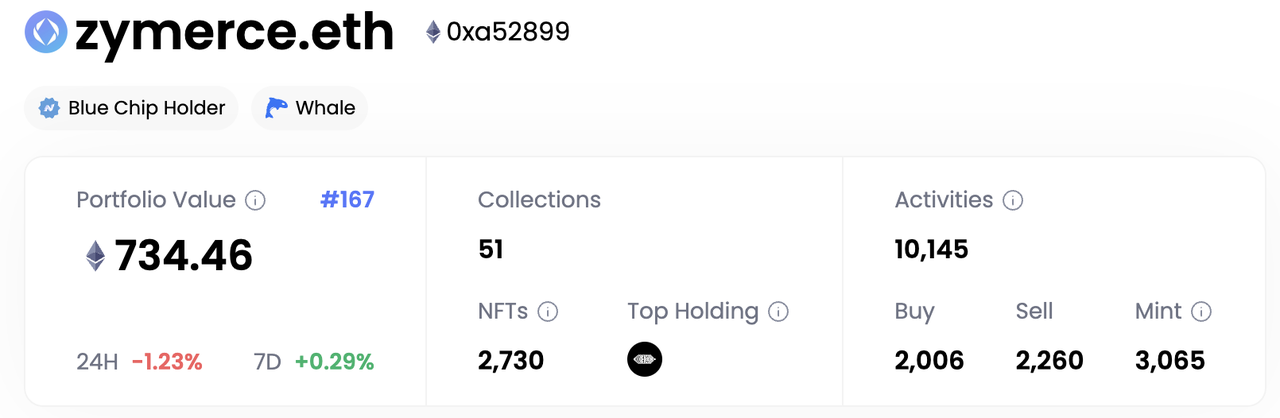

Zymerce.eth operates with a long-hold strategy, acquiring NFTs in bulk during price dips and maintaining them in an extensive portfolio.

Currently, the portfolio boasts 2730 NFTs, with 51 collections. His recent trading activities brought his portfolio with 15 Ether Avatar and 75 Ether Capsules.

Furthermore, the address is evidently well-versed in the game Legends of The Mara (LOTM), demonstrated by the large-scale minting of Otherdeed Expanded and Otherside Vessels, which holding numbers are 757 and 729 for each.

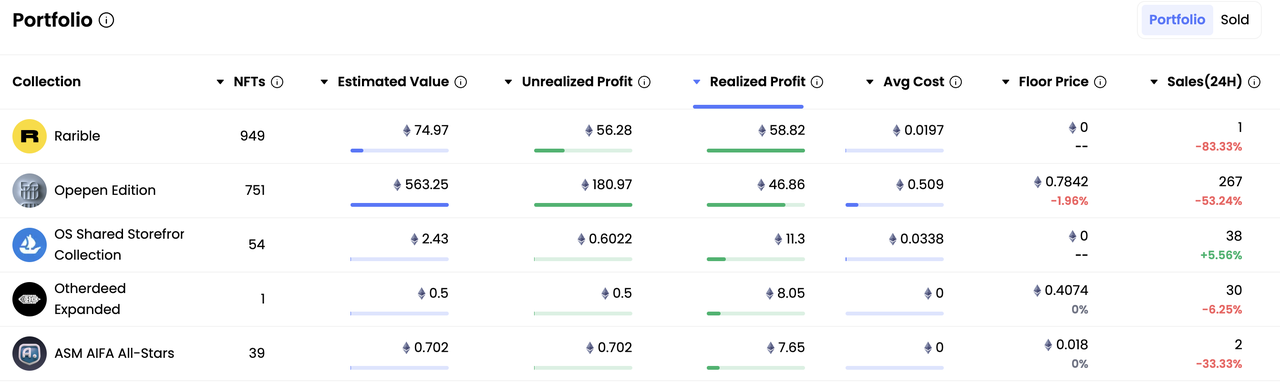

Bored.eth exhibits a strategy of tapping into trending topics and recognizing potential in various NFT projects.

An example of this is the Opepen Edition, which the investor has been purchasing for two months, accumulating a significant holding of 751 Opepens, which realized 3x profit.

His transactions, featuring a plethora of NFT projects like Metropolis World Passport Official, Sappy Seal, and the Nifty Portal, suggest a diversified investment strategy aimed at uncovering valuable gems in the NFT landscape.

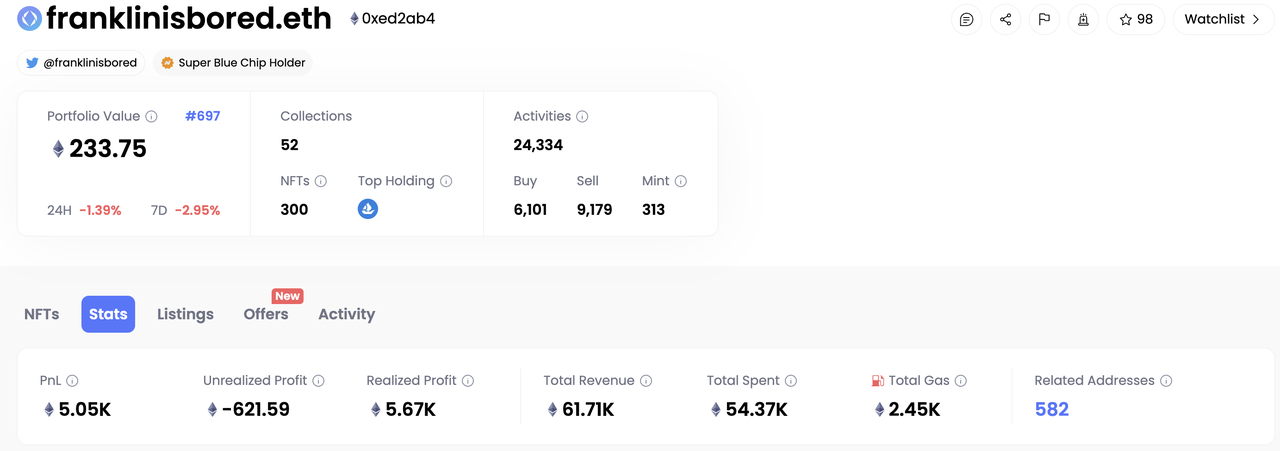

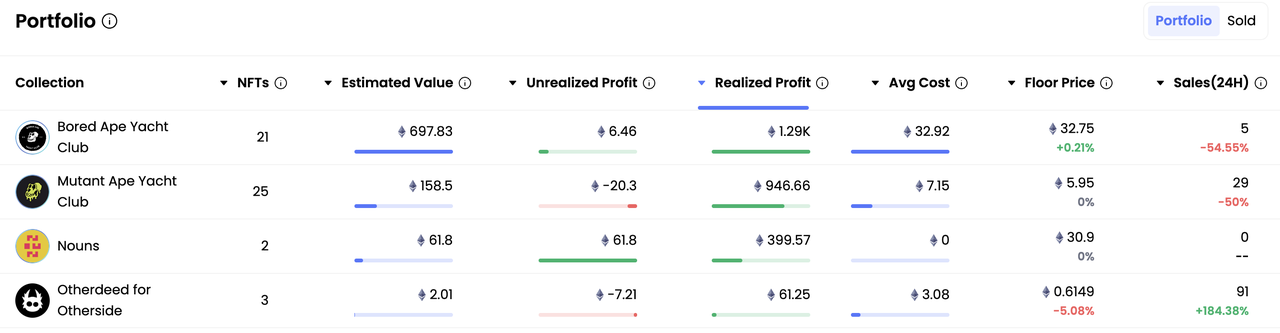

Twitter: @franklinisbored, is famous for flipping his NFTs. Most of his trade focused on BAYC and other Yuga Labs' collections, so for a Yuga Lab collectors, follow him could bring insightful opinions both on trading time and valuable traits.

Three of his collections realized profits more than 1K ETH, the first is BAYC with 2.55K ETH, the second is Wrapped Cryptopunks with 1.78K ETH, and the third one is Otherdeed for Otherside with 1.08K ETH.

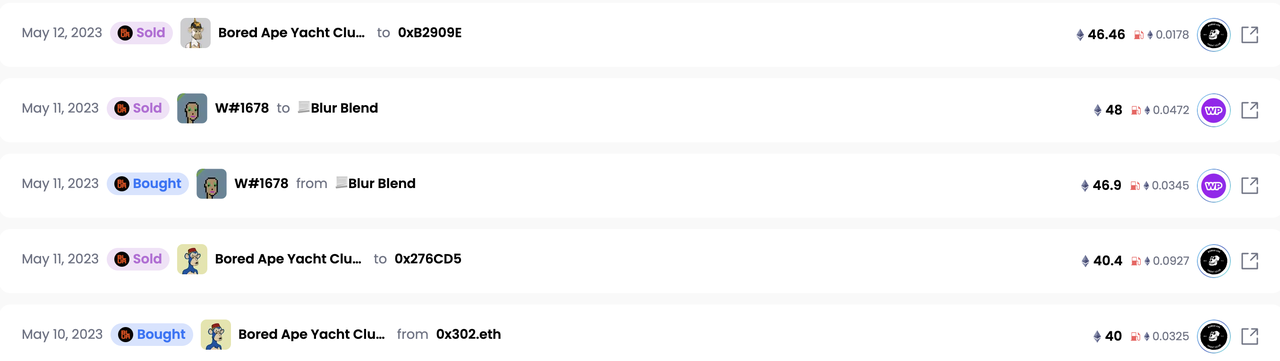

We can find that most of his trades were received or bought via Blur Blend.

Another interesting point, at the current stage, franklinisbored is still buying heavily and is not selling, which shows his positive belief in the future market.

Twitter: @machibigbrother, is known for flipping NFTs. His trade focused mostly on BAYC, MAYC, Azuki, Azuki Elementals, Ether, and DeGods.

Most of this address's NFTs were traded vis Blur Blend, and this address also in Blur's Season 2 Leaderboard Top 5.

Publicimage.eth focuses on high-profile collections like CryptoPunks, BAYC, V1 Punks, and others.

Also, he demonstrated an aptitude for capitalizing on market declines. Interestingly, this investor operates with other trading addresses, frequently transferring NFTs to 0xbbaec56b725a0b9501a655d7d1b48555af637b70, keeping the original address free of any holdings.

This use of multi-addresses suggests a sophisticated trading strategy aimed at optimizing transactions, asset management, and perhaps adding a layer of privacy or security.

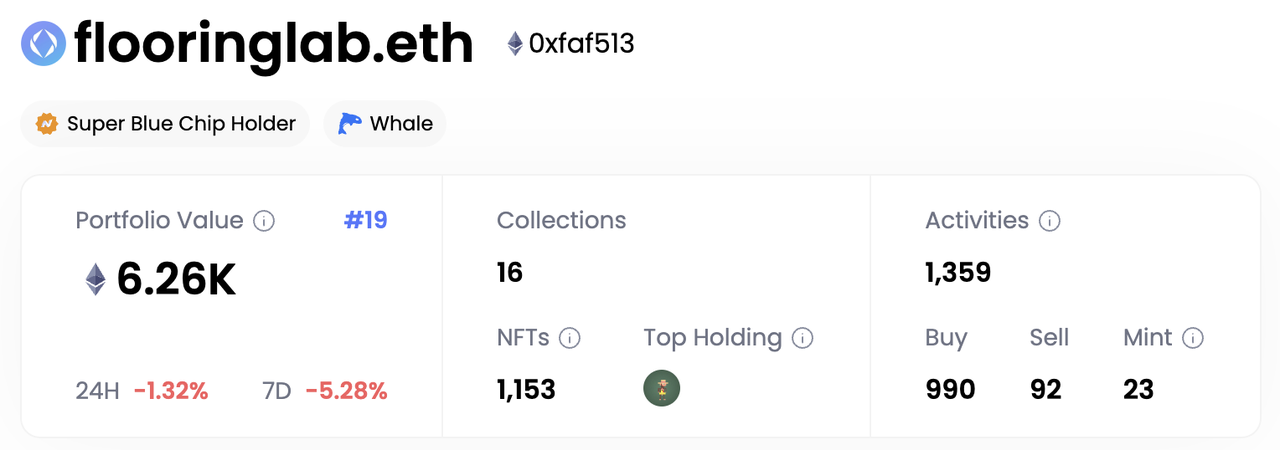

flooringlab.eth represents a major player or 'whale' in the NFT market, with an impressive portfolio including 197 Azuki Elementals, 166 Azuki, 89 BAYC, 82 MAYC, and 35 Pudgy Penguins.

Over the past three months, this investor has purchased a staggering 990 NFTs from various high-profile collections such as Dinks, Azuki Elementals, Azuki, BAYC, and MAYC, while selling only 92 NFTs.

His continuous acquisition of NFTs, even during a bear market, underscores a long-term investment strategy banking on future value appreciation.

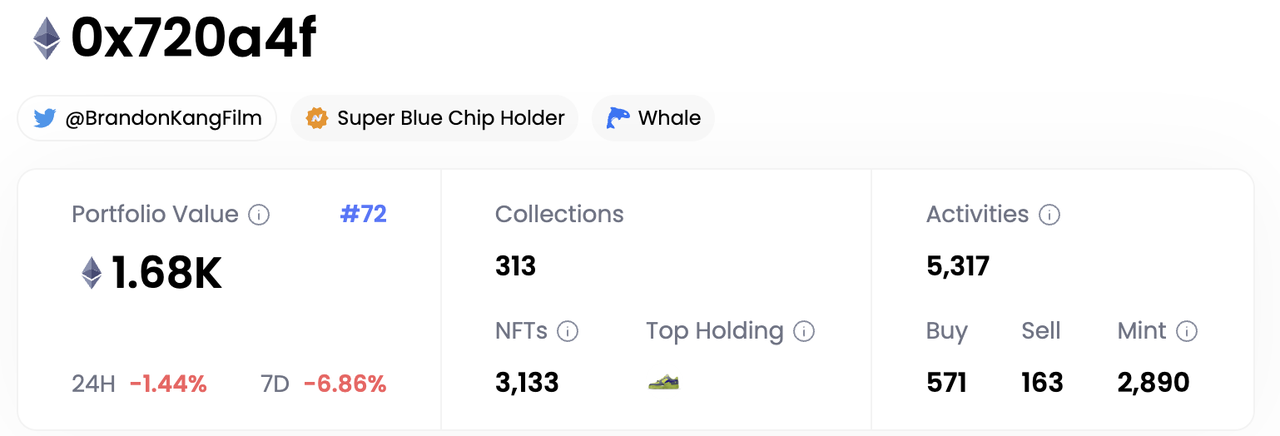

Whale Holder: Twitter: @BrandonKangFilm holds 92 Otherside Vessels, 92 Otherdeed Expanded, 41 MAYC, and 31 BAYC.

His recent activities include listed 17 of his BAYC at more than 200 ETH price with the highest one BAYC #2342 at 888 ETH.

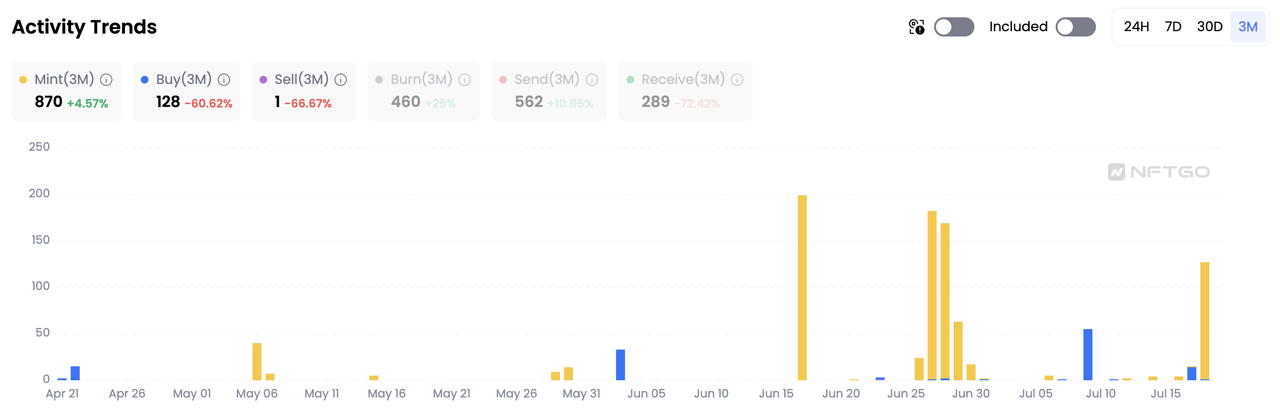

Twitter: @dingalingts. This address is renowned for its 'diamond hands' with the Azuki collection, holding an impressive 121 Azukis, 245 Azuki Elementals, and 34 BEANZ.

Recently, the focus of this investor's activity has shifted towards exploring emerging NFT projects. For the last three months, he has minted 870 NFTs.

By examining these leading players, we have identified key techniques such as bulk buying during price dips, strategic selling, platform diversification, targeted minting, and holding onto assets during bear markets. If whales can detect opportunities ahead of time, under the help of GoAlerts, both novice and experienced investors can track the real-time activities of these influential investors, anticipate market trends, increase their odds of identifying potential opportunities ahead of time, thereby maximizing returns and minimizing risk in the volatile NFT market.

Disclaimer: The above information is for informational purposes only. Investing in digital assets such as NFTs and cryptocurrency brings with it a high degree of risk. Please consult with a financial advisor before making any investment decisions. NFTGo does not provide financial advice and is not responsible for any losses incurred as a result of investing in digital assets.