What is NFT wash trading?

Wash trading or "painting the tape" is a form of market manipulation whereby market players attempt to influence the price of a security by buying and selling amongst themselves to create the appearance of substantial trading activity.

The practice of wash trading may be to create the illusion that demand for a project is higher than it actually is, or simply to mine activity rewards offered by platforms that encourage platform activity.

The current conditions

The traditional securities and futures markets prohibit wash trading, but it's still commonly seen in the NFT market as the market is still in its early stages of development. According to NFTGo.io, there are currently 1075 collections and more than 82,000 addresses involved in wash trading. Moreover, the number of wash trades across the network has amounted to more than 250,000.

Some projects employ wash trading to pump prices as a means of marketing, which is an attempt to deceive users with data. However, since there are many reasons and ways to achieve wash trading, one cannot generalize. Furthermore, among the top 10 projects with high levels of wash trading, there are some little-known projects as well as potential blue-chip projects like Meebits. The figure below shows the top 10 projects involving wash trading, with R*** and T*** ranking first and second in percentages.

Most wash trades are instantaneous, of high frequency, and take place over a long period. According to NFTGo.io, most wash trades require 5 minutes to complete a cycle, this means that in order to avoid the impact of market volatility, "wash traders" would prefer to perform their actions as quickly as possible. If the action period is too long, the price may fluctuate, and they may lose profit to other parties.

By understanding the above, we're able to identify the key factors to wash trading and target certain behaviors—the buyers and sellers are often single or multiple addresses under the control of one person. Just as the former first lady's wash trading was suspected, we can do the same to detect wash trading from on-chain data.

Interestingly enough, our data doesn't show a linear decrease in elapsed time. We can see cycles that span one and three days are more abundant than those that span only 1, 1.5, or 2 hours. This may be related to another pattern of money laundering we found. For example, when studying projects such as CryptoKitties and Axie Infinity, a large number of closed cycles with recurring addresses were found in their transaction records (e.g. 0xb1690c08e213a35ed9bab7b318de14420fb57d8c had over half a million closed-cycle transactions), exhibiting an apparent money-laundering characteristic. However, once the criteria are limited to the hourly level, no closed-cycle transaction is detected. This finding is contrary to the high frequency characteristic we mentioned before.

Why does the one-day cycle period show a high frequency? Studies have found that these click-farming types of transactions have one thing in common: one address would trade all of its NFTs (usually over thousands of them) in one day, then repurchase them the next day to close the cycle. As the quantity involved is enormous, these seemingly "sluggish" trades often generate a significant volume of transactions, thus creating a false picture of a booming market.

The purposes of wash trading

At present, Ethereum is among the top of all public chains in terms of the number of NFT projects launched and daily trading volume. To some extent, this makes wash trading easier to be covered up. Wash trades performed on Ethereum cost substantial gas fees, which means "wash traders" who are capable of affording these costs are likely well-funded and have clear and thoughtful strategies.

Generally speaking, wash trading is recurring, and the collections involved are of a wide range. Some of these are malicious acts perpetrated by project developers, while others are profit-gaining tactics of users.

There are mainly three purposes of wash trading. First, to cause speculation for a project. This is done by pumping the price and trading volume of the project with funds so as to attract buyers. Secondly, money laundering. Some hackers launder "dirty money" through the NFT market and then obtain the "clean" version as a result.. Third, to gain $LOOKS earnings and boost the price of their NFT assets. It's common to see people perform wash trades on LooksRare to earn LOOKS, such as trading back and forth twice each time, once a day. Therefore, frequent transactions well above the floor price, irregular transaction records under the same address of a single NFT, etc. can be used as a basis for identification.

Identifying wash trading

We enumerate the on-chain behaviors of "wash traders" by assuming their possible paths. First of all, the same user may create multiple sub-wallets in order to perform transactions between their own wallets. These wallets need to have enough funds to interact before they're ready to trade, and some traders transfer money directly from their main wallet, thus creating a one-to-many structural association. On the basis of this behavior, we capture the multiple sub-wallets created by the user. Currently, we're able to "trace" wash trading transactions through on-chain data and track the main wallet to determine the identity of the trader, but once the funds exit the marketplace, the chain "breaks."

Secondly, we perform wallet correlation clustering to capture closed-cycle transactions between wallets. If two or more wallets have been conducting uninterrupted high-frequency transactions and have not been interacting with other wallets, such wallets can be deemed suspicious. With these two on-chain behaviors, we are able to identify some programmed wash trades and thus identify sub-wallets in reverse, but the downside is that we do not know the identity of the "wash trader" when the funds come from off-site.

Thirdly, the transaction history of a particular NFT shows that the same NFT has been traded multiple times in a short period of time at a price well above the floor, with no significant change in the position.

These are the key actions used by "wash traders" to fulfill their needs (raising floor prices, increasing trading volume, etc.). Additionally, they must reduce losses as much as possible. This is why LooksRare's zero transaction fee policy attracted many projects that aimed to do so. Through the minimum cycle of "creating multiple wallets - transferring money to each wallet - purchasing NFTs with each wallet - and inter-wallet transactions," a wash trade is done. This way, the NFTs and funds are always held by one person.

Usually, in a wash trade, NFTs and funds will return to the trader's initial address or to the trader's wallet via an OTC trade. Therefore, with the "primary trader - other addresses - primary trader" cycle, we can categorize the trade flow based on address clustering and priority.

Types of wash trading activities

By using data analysis and quantitative algorithms, we can break down the types of NFT wash trading activities. An example is closed-cycle transactions between two or more parties: a single transaction (sale) is regarded as one act, two closed-cycle transactions constitute a binary loop, and three transactions constitute a closed-loop called a ternary loop; abnormal transactions between multiple addresses under the control of the same party, etc.

Based on the above classification, we have found that closed-cycle transactions between binary loops amounted to the highest number, which was followed by triple loops.

How to use NFTGo.io to eliminate “noise” and take hold of the data?

We are very excited to announce that NFTGo.io has recently implemented a new wash trading feature to filter out wash trading activities across all of our collection dashboards and major indicators, including price, volume, traders, sales, and whales tracking, etc. Through extensive research, algorithmic analysis, and tracking transactions of each listed project, our team has developed strategies to identify wash trading activities. We are also one of the first NFT analytics platforms to incorporate this feature into their data and open it to the masses.

Suspected wash trades are now being filtered automatically on the NFTGo.io platform across key metrics on pages, including collection, NFT, address, marketplace, and market overview.

Additionally, we enable users to remove this noise by using the "Filter Wash Trades" feature to better engage in the market.

Please refer to the product doc for more details on key metrics and pages that already have wash trading filter implemented to display unbiased data. https://docs.nftgo.io/docs/wash-trade-filter

Wash Trading Filter and Tagging

On top of the Price and Top Sale charts under each collection page, there is now the new “Filter Wash Trades” button. This feature enables users to get an actual view of market activity with wash trading activity filtered out.

Taking the example of Meebits 7D data, you can see the data looks very different with and without wash trading activities, which will create bias.

Before switching on the wash trading button:

After filtering wash trading activities:

When the filter button is turned off, a red flag is tagged next to all suspected trades as a reminder to users. By turning on the button, these trades will be hidden from the list.

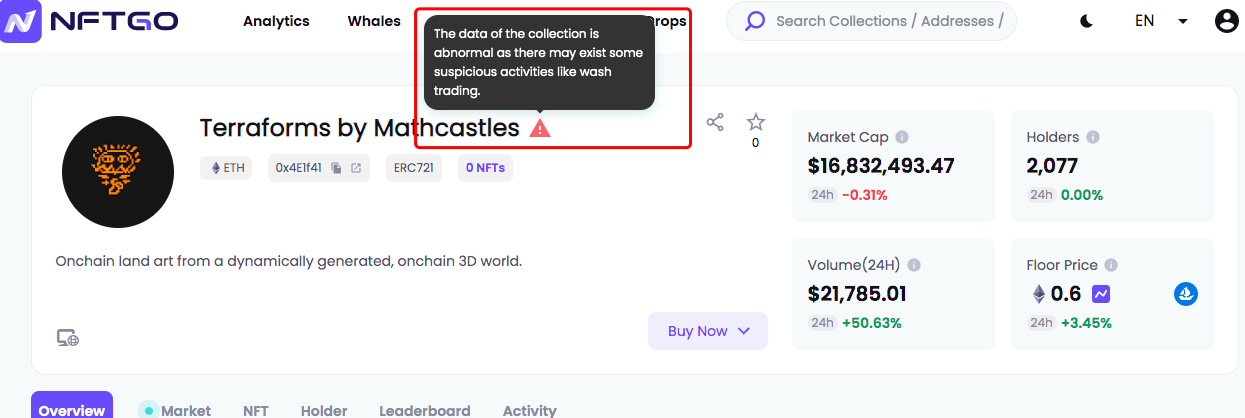

Abnormal Collections Alert ⚠️

If a collection is associated with too many wash trading transactions that affect the overall ranking of some key metrics, we will tag them as abnormal collections.

Conclusion

While there is no apparent way to completely eliminate wash trading, it is possible to find solutions from the cycles mentioned above. For instance, adding KYC to the interaction between the sub-wallets and the marketplace would allow for the identification of "multiple wallets per person," although the marketplace might lose some privacy-conscious users as a result.

As the market develops, different types of wash trading have emerged, and some projects even conduct such trades explicitly, producing fraudulent data to disrupt the market. As Web3 users, we should learn to identify and utilize data tools to help us see clearly through the fog.

Note: The above information is for informational purposes only. Investing in digital assets such as NFTs and cryptocurrency brings with it a high degree of risk. Please consult with a financial advisor before making any investment decisions. NFTGo.io does not provide financial advice and is not responsible for any losses incurred as a result of investing in digital assets.