Key Takeaways

-

A substantial 55.85% of DeGods holders have showcased loyalty, maintaining their NFTs for more than 3 months on Ethereum.

-

The past three months saw a 44.38% increase in total owners, a 44.4% surge in 'whale' holders, and an impressive 52.2% growth in blue-chip owners.

-

On August 17, DeGods' trading volume reached a stellar 2.6K ETH, outpacing other NFTs and asserting its dominant market position.

-

0xFC6666 emerges as a central figure in DeGods' trading, notably securing 6 out of the 10 top DeGods sales in the past month.

-

@machibigbrother's unique trading strategy showcased a strategic divestiture post-Season III, with transactions at times making up a quarter of the daily volume, suggesting DeGods' high liquidity as an attraction for large-scale traders.

-

The Season III update brought about adjustments in the floor price, but based on past behavior like July 4th, there's potential for the market to find equilibrium and regain strength in the coming future.

Season 3 Comprehensive Update with Holders' Views

On August 10th, DeGods announced their Season III update. The update mainly includes three parts: the migration of y00ts from Polygon to Ethereum, the update for "Downgrade" art, and then opening of Points Parlor.

Migration of y00ts from Polygon to Ethereum

The y00ts community will shift from Polygon to Ethereum, with the grant from Polygon being returned. The date has not been announced, and this move aims to consolidate the DeGods and y00ts communities and allows Polygon to redirect funds to nurture the broader NFT ecosystem, emphasizing creator and developer support.

As a DeGods and y00ts holder, @bweys_nft stated, though there's some troubles in the release of s3, Frank & team have room to start over delivering again behind clear value prop and humbled community.

Season III "Art Downgrade"

DeGods unveiled Season 3 of its collection on August 13, introducing an "Art Downgrade" after backlash from a previous "art upgrade." This new approach aims to offer a vibrant and nostalgic style without diluting the original collection. DeLabs believes this revamp will "redefine the NFT space." Season III will integrate 20,000 new generative art pieces, offering enhancements to existing DeGods without overshadowing them. The collection will also expand in diversity with the inclusion of swappable female versions. Responding to community feedback, DeGods has removed undesirable traits, minimizing gore and emphasizing inclusivity.

@oCalebSol shared about the Top 5 BEST vs WORSE DeGods S3 downgraded traits.

@PixSorcerer shared his conclusion on how 9 different DeGods changed with Season 3 art inside.

Opening of Points Parlor

DeGods recently launched Points Parlor, a gamified platform developed by Dust Labs. This innovative system not only enhances community engagement and DeGods’ brand visibility but also serves as a unique ad product linking brands with DeGods holders. Users earn loyalty points by holding DeGods NFTs, which they can use to unlock prize packs. These prizes include the $DUST fees from Season 3’s art "downgrades" and over $250,000 USD in brand-sponsored rewards. The gameplay is intricate, with layered mechanics involving varying prize distributions and fluctuating pack prices. The initiative, sponsored initially by Kraken NFT, features impressive prizes, including a Tesla. Furthermore, other brands are invited to join the venture by offering prizes, presenting an engaging way to connect with the DeGods and y00ts communities.

@alea_eth shared the insights that the points parlor by degods is a flywheel.

@pixsorcerer shared some experiences on how to win a Tesla via points parlor.

@0xJustin3333 said that the best part about Points Parlor though is that it is scalable and easy to update. The delivered product works perfectly, but the prizes just need tweaking.

Holders' Comprehensive Analysis or Opinion

@cryptoleon_eth provided a whole explanation on DeGods III & y00ts FUD.

@JudoCrypto compared DeGods with four other well known companies to point out that pivoting when necessary is crucial for any company.

@davincithreads points out the potential weekness in their business plan.

@AaronSage talked about what and why he's disappointed with Degods.

@HMuschang believes that the team gives their all for the community and does their best.

Data Analytics

Holders

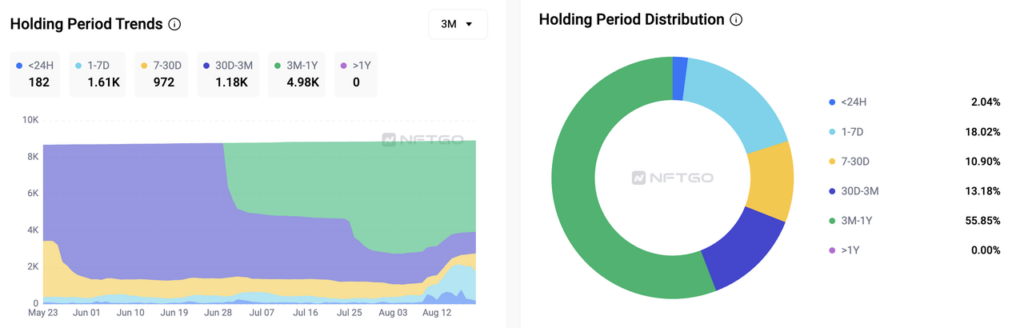

Holding Period: Long-standing DeGods Holders React to Market Changes Post-August Updates.

The holder distribution of DeGods offers a revealing glimpse into both the current community sentiment and its overarching market trajectory. About 55.85% of DeGods NFTs are held by users who've been committed for 3 months to 1 year, showcasing robust loyalty. These diamond hands within the DeGods community initially burgeoned from a transfer of 3.6K holders from Solana. Yet, the noteworthy aspect is post this Solana-to-Ethereum migration, the new holder count on Ethereum has nearly doubled, signifying the transfer's successful impact on expanding the community.

An analytical dive into the nuances of the holder patterns, specifically between July 25 to July 30, aligns perfectly with the overarching trend observed from April onwards. However, a pertinent deviation was observed post-August 10, as some long-standing holders decided to diversify their portfolios. This decrease peaked on August 16, with a subsequent level off. During this period, exceeding 1K DeGods, which had been in possession for over three months, re-entered the market. This shift reflects both the strategic decisions of seasoned holders who saw new opportunities after the updates, but also provide those new investors opportunities to enter into the DeGods community.

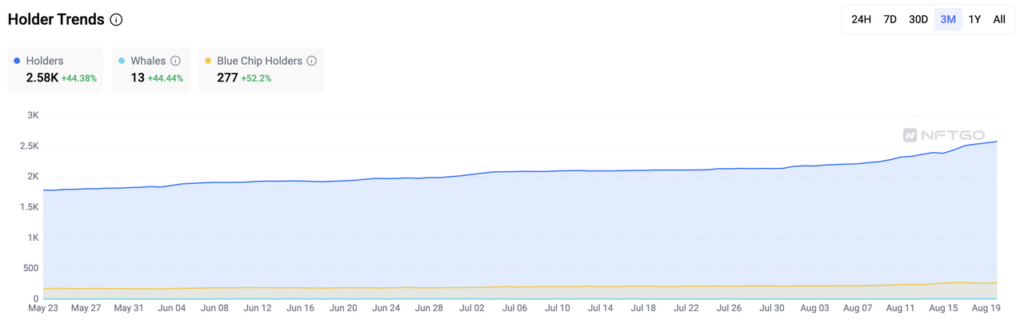

Holder Trends: New Holders Emerge Amid Volatility & Investors See Long-Term Potential

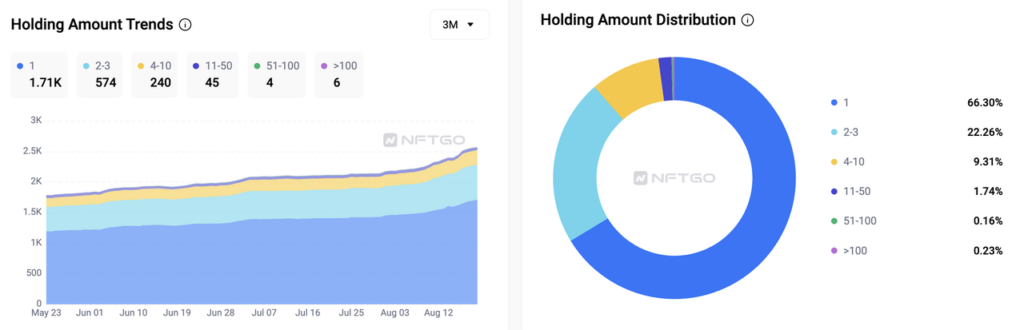

Although we saw some long-term holders liquidate their holding, the total number of holders increased dramatically. The fluctuations in DeGods held for durations less than 24 hours underline an active, volatile market. 17.82% of DeGods held between 1 to 7 days post the recent update, which increased from 399 to 1741, highlight the influx of a new generation of owners, thereby invigorating the DeGods community. Although 50% of these NFTs transitioned from being long-held assets to re-entering the active trade market within a week, the growth of new holders is still not negligible.

A holistic view of the ownership statistics reveals an optimistic narrative. Over the last three months, there has been a substantial growth in the owner demographic: a 44.38% increase in total owners, a 44.4% spike in 'whale' holders, and a robust 52.2% increment in blue-chip owners. This trajectory solidifies the premise that DeGods is not only magnetizing the casual players but also drawing in astute investors who envision long-term growth potential.

Lastly, in terms of the granularity of holdings, most of the market, roughly 90%, comprises holders with up to 3 DeGods. While the growth has been relatively steady for individual holders, a notable disruption was observed between August 14 and 15, where approximately 10 holders made acquisitions only to sell shortly after.

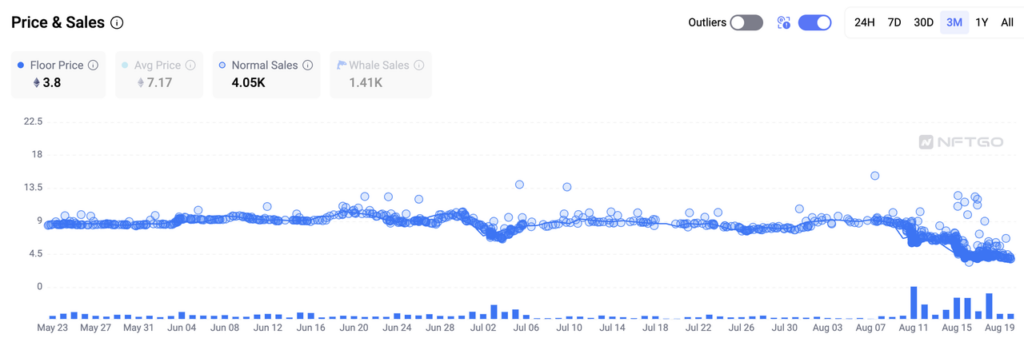

Trading: DeGods' Trading Surge Post-Season III Proves its Pinnacle Status in the NFT Landscape

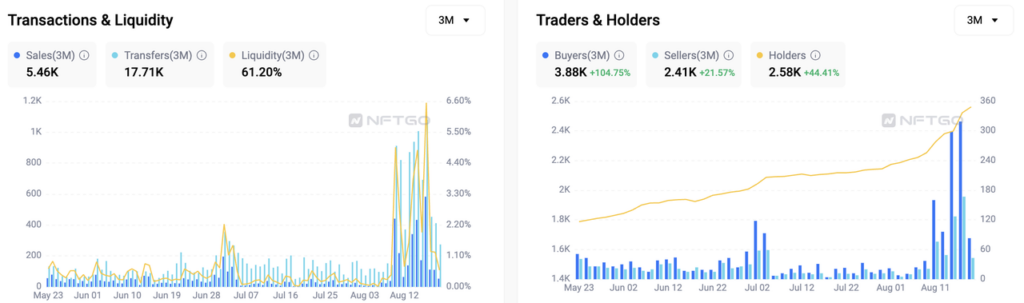

The trading patterns and dynamics surrounding DeGods over the past three months reveal several significant market trends and individual behaviors that shed light on its market position and influence.

From early June to the onset of August, trading activities around DeGods were relatively subdued, presenting a lull in the market. However, this tranquility was disrupted with a surge in trading activities around August 10, coinciding with update of Season III. This spike wasn't limited to just DeGods’ loyalists but was reflective of a broader NFT market sentiment. It underscores the pivotal role that DeGods holds in the current NFT landscape, reinforcing its status as one of the most observed and influential NFT series today.

In the immediate week succeeding the update on August 10, there was a noticeable increase in DeGods' liquidity, which magnified to approximately five times its normal volumes. Transactions surged to an impressive 600 trades daily, with liquidity touching a peak of 1.2K. Although this surge did not last for a long time, DeGods still shows its high liquidity compared to other top collections like BAYC.

Drawing insights from NFTGo data also provides another dimension to the DeGods' trading narrative. On August 17, the trading volume for DeGods astonishingly reached 2.6K ETH, thereby eclipsing all other NFTs and firmly positioning itself at the zenith of the NFT market.

Whale Activity: A Deep Dive into DeGods' Market Fluctuations and Influential Players

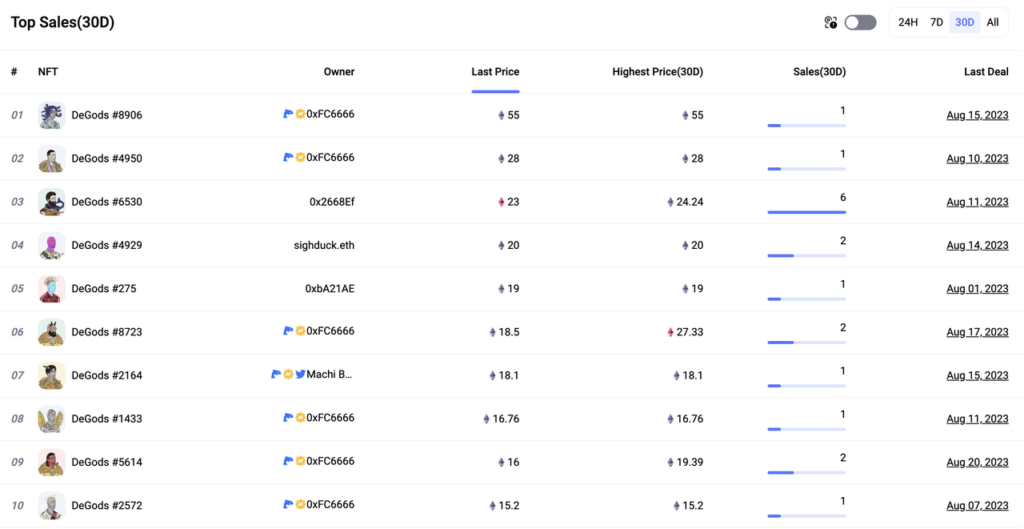

0xFC6666 Emerges as a Dominant Force in DeGods Market with Strategic High-Value Acquisitio

ns

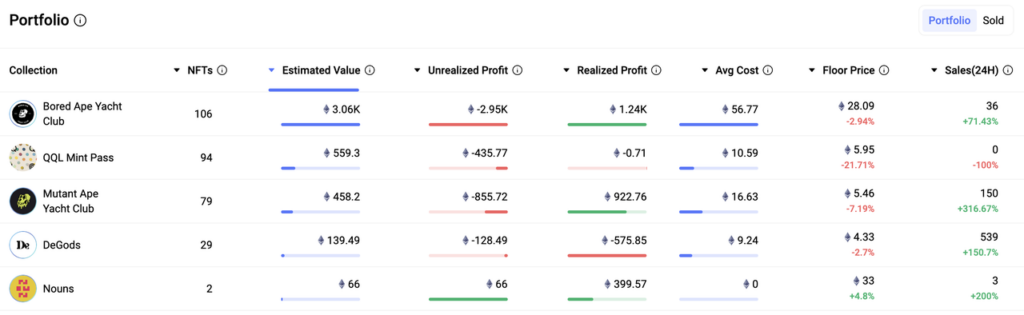

Diving deeper into the analytics, we identified intriguing patterns in whale activity, which appeared to correlate with the fluctuations in the floor price. One notable point in examining the recent dynamics of DeGods is 0xFC6666's purchasing patterns. Over the past 30 days, this individual remarkably accounted for 6 out of the 10 top DeGods sales, with a crowning acquisition of DeGods #8906 at 55 ETH, followed by a 28 ETH purchase for DeGods #4950. Currently, 0xFC6666 is still holding 301 DeGods, with 34 of them were bought after August 10th. The majority of these acquisitions transpired on the Blur platform, punctuated by singular transactions on X2Y2 and four from OpenSea. This buying behavior underscores 0fx6666's significant confidence on DeGods market trend, and shows his influence on the DeGods market landscape.

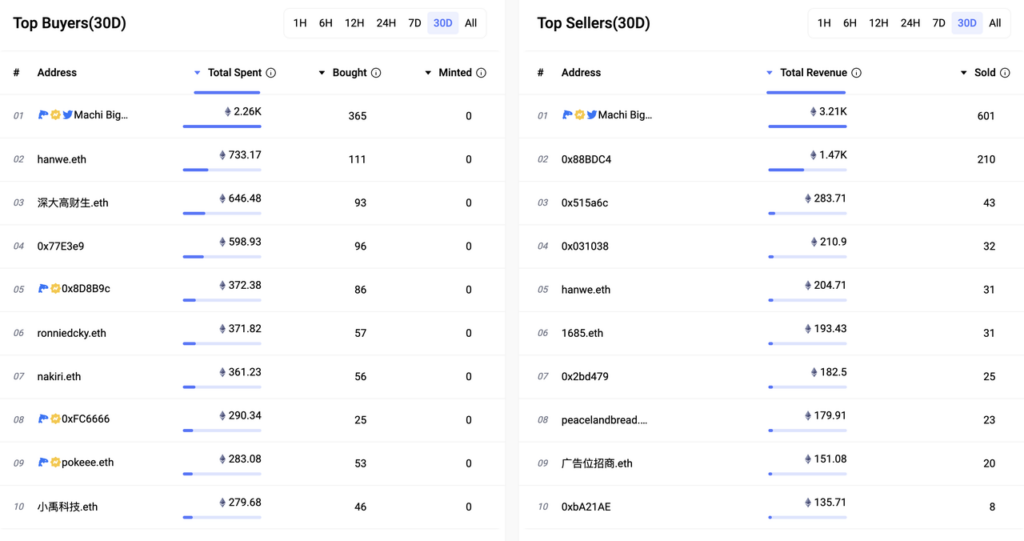

Machi's High-Volume DeGods Trades Signal Strategic Divestiture Post-Season III Launch

Among these high-volume traders, @machibigbrother displayed extraordinary trading activity. Followed by him, we also noticed the top buyers like @RonnieDcky and @pokeepandaa. It is interesting to notice that RonnieDcky also shared his experience on how he come back from 20E Loss on DeGods to 1E profit:

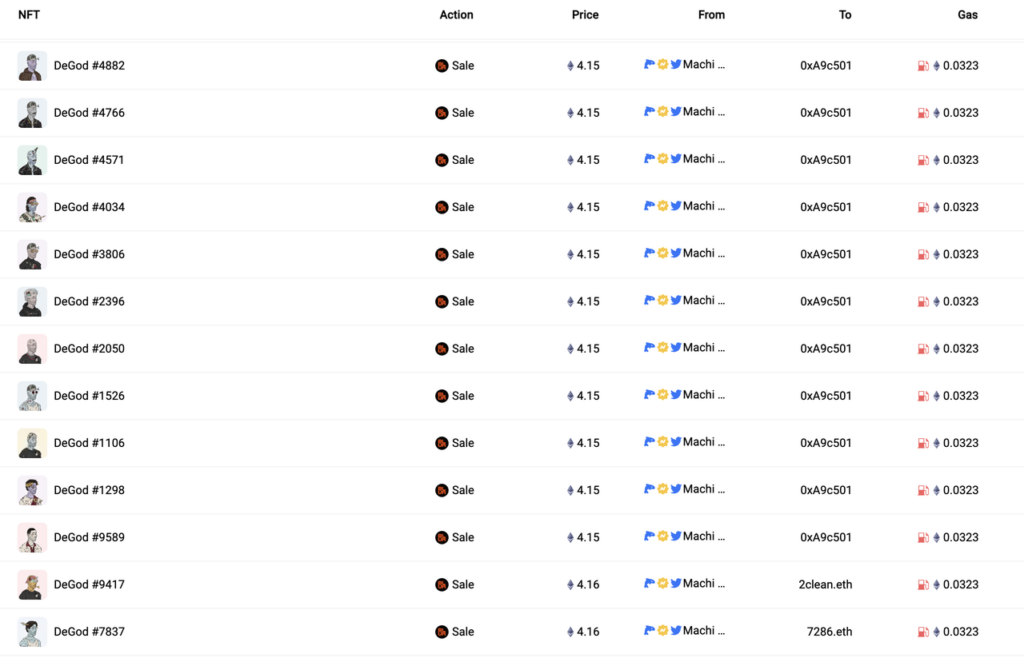

For Machi's trading pattern, over the past 30 days, Machi's trading ledger recorded 365 acquisitions and a staggering 601 divestitures. This nearly 2:1 ratio of sales to purchases suggests that Machi had amassed around 300 DeGods prior to the introduction of Season III.

Machi's trading alone constituted about a quarter of the daily volume. Utilizing real-time data from the NFTGo platform, it's evident that Machi's trading patterns leaned heavily towards divesting a colossal number of DeGods concurrently. Such voluminous and simultaneous transactions have the potency to send ripples across the market, causing potential price disruptions and influencing market sentiment.

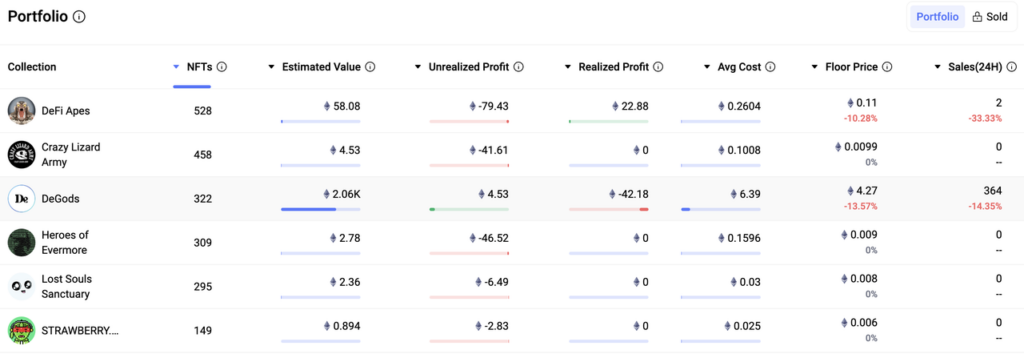

Currently, a glance at Machi's portfolio illuminates his diminished DeGods holdings, registering a count of 29 from a formidable 322 just the previous day. However, it is common for whales like Machi to focus on flipping the most liquid NFTs. During this period, DeGods consistently ranked highest in liquidity, with trading volume over 10x greater than the second-highest collection. This helps explain why Machi frequently targets DeGods for trades, as its market liquidity makes it easier to buy and sell in high volumes.

Floor Price Experiences Decline Following Season III Update

The floor price of an NFT collection often serves as a bellwether for the market's perception of its value. As of our last data checkpoint, DeGods' floor price stands at 3.8 ETH, marking a decline of over 50% in the span of the past three months.

While there were fluctuations in the floor price over time, they illuminated the dynamic nature and resilience of the DeGods market. The first notable adjustment in floor price was observed on July 4th. However, this time's price drop was short-lived, as the floor price made a steady recovery to its previous stance within just a month, manifesting the elasticity of DeGods' floor price and underscoring the unwavering commitment of the community to the DeGods culture. Another drop was documented post the launch of Season III. On August 10th, immediately following the Season III update, the floor price plummeted from 8.75 ETH to 6.65 ETH, a stark 24% reduction. This downtrend persisted, and between August 13th and 15th, the floor price underwent another slide, moving from 6.64 ETH to 4.47 ETH, translating to an approximate decline of 32.68%. However, just as we observed after July 4th, this adaptation might signify the market's evolution and the potential for a bounce-back.

Opinions from the community

In the process of doing this report, we reached out to many DeGods community members for their insights. We are grateful that many of them have been willing to contribute to this report. Here are some of the opinions we have gathered, and we hope to present them as they truly are.

How do you see the update of Season III, and the relationship between y00ts and DeGods evolving in the future?

Carl (Twitter: @Carl_m101):

From an art perspective, I really like the DeGods “downgrade” as the reduced colors and traits give them a much cleaner look with way more mainstream potential. This will give holders more options to utilize their DeGod as a branding. It also moves DeGods closer to y00ts from an art approach. y00ts have always been very clean with a great mainstream and branding appeal.

Anonymous:

-

It's clear by now that season 3 did not live up to the hype.

-

The communication was fumbled.

-

The art did not wow, leading the team to pivot.

-

Points parlor rewards didnt make sense.

-

-

Y00ts had it the worst, all they got as an announcement that they are moving to ETH, no new art yet, no points parlor.

The big lesson for Frank here is too change his marketing strategy. Frank has traditionally followed a microsoft vaporware marketing approach. It’s time for him to look at other models like Apple that drops something when it’s ready. Season 3 would have gone completely different if there was no hype. Or even traditional Google that releases products in beta.

The second lesson is that Frank needs to run his ideas by more people even at the risk of leaks. But getting something right is more important.

The principles behind an art upgrade or points parlor are sound, it’s just the execution that needs work. I totally believe in Frank in the long term. This is just a short term setback.

What were your thoughts for y00ts on the migration to Ethereum?

Anonymous:

I do expect that y00ts will do far better on ETH. Initially when the announcement was made the floor jumped to 2e on the news. A good art update for y00ts will be welcomed but any improvement on y00ts only increases competition with DeGods. It will be up to the team to figure out what to do next.

Do you believe this was good timing for the y00ts migration to ethereum?

Anonymous:

Absolutely. Polygon as a centralized NFT marketplace does not get much attention. I realize that many big brands use polygon but only through their own private portals, in a way that does not drive attention to other brands. By getting on ETH, expect y00ts to get 1e and be within the top 10 NFT projects by volume.

Carl (Twitter: @Carl_m101):

Timing can never be perfect, but I believe it was a necessary move to have y00ts on the biggest blockchain. Maybe having this as a completely separate announcement afterwards would have been a better move to appease holders .

In terms of DeGods and y00ts, I really hope these will be much closer in the future, sharing utilities and network effects, which was not easily possible before.

How will migration affect the relationship between DeGods and y00ts in the future?

Anonymous:

Increased competition so that people who want to be part of the De Labs ecosystem will have to choose between y00ts and DeGods. But hopefully there will be some network effects. You could imagine a larger family growing faster. Ideally there will be clear product differentiation between the two collections so there is no competition but I doubt it.

The market seems to have these small flurries of activity when these announcements are being made. What do you see as the next thing that will increase trading again?

For De Labs, you should expect a lot of announcements that will drive the price $DUST higher within the next 30 days. The team is highly incentivized for $DUST to go up because their 1 year cliff is coming due (remember last year they got a VC round (Sept 2022). So expect to hear about DUST DAO, DUST driven Marketplace, DUST Auctions, etc.

The market seems to have these small flurries of activity when these announcements are being made. What do you see as the next thing that will increase trading again?

Carl (Twitter: @Carl_m101):

As it seems right now, no announcement can actually move a market long term, although it seems as if this one has started a never-ending downward spiral again (similar to the Azuki Elementals reveal). The market just had too high expectations again, which is never a good thing - especially in this bear market.

What we need is new people joining in, but this is most likely not happening until we see several conditions change.

What do you think will be the next booming topic in the NFT market?

Carl (Twitter: @Carl_m101):

I believe we will see many projects introduce “real world” utility. This will most likely move from a web2 perspective, meaning many traditional companies will move into web3 utilizing the technology for their products rather than launching nfts for marketing purposes. This has already started with the F1 and Airlines (see my threads on these) utilizing the blockchain as customer “loyalty” programs. I’m definitely bullish on the tech long term and think the real revolution is yet to come.

Anonymous:

For PFP NFTs:

To me it’s all about virtual identity. Which relies on frequency of use. Right now pfp NFTs are only for profile pictures. We need to go beyond that to something far more personal and practical:

I believe the next boom will come from VR. People don’t realize what’s about to happen with VR and the metaverse. Soon you will be scanning your face and selecting a NFT “skin” to cover your face as you talk… your entire body in fact.

Conclusion

The DeGods NFT collection stands as a beacon of prominence and potential in the NFT world. Representing both seasoned enthusiasts and new entrants, the landscape reveals a vibrant and rapidly expanding community. Approximately 56% of holders maintain their commitment, fortified by the seamless Solana to Ethereum migration. The surge in trading post the Season III update and strategic activities by influential traders, like 0xFC6666 and Machi, highlight DeGods' pivotal market role. Adjustments in floor price, while notable, are met with unwavering community resilience, emphasizing the market's elasticity. Such dynamics reflect not just active engagement but an enduring faith in DeGods, suggesting a bright future for this NFT ecosystem.